April 8, 2024

New Tax Year 2024/25

As the 2023/24 tax year concludes, it’s time to get your ducks in a row: If it’s the first year […]

There are no results for your filter, please try again.

April 8, 2024

As the 2023/24 tax year concludes, it’s time to get your ducks in a row: If it’s the first year […]

March 13, 2024

Introduction • The Chancellor, Jeremy Hunt, has just delivered the Government’s Spring Budget, which could well be the last fiscal […]

November 22, 2023

The Chancellor, Jeremy Hunt, has just delivered the Government’s Autumn Statement which is likely to be the penultimate fiscal statement […]

November 15, 2023

For many years Autumn Statements did not create much interest outside of economic and political circles. They were more like […]

April 25, 2023

Location Belfast / Hybrid Working The Role Due to continued growth in our Deal Advisory team, we are now looking […]

April 25, 2023

As the nights get longer and we start to feel a bit of warmth in the air it is an […]

March 15, 2023

Earlier today, Chancellor Jeremy Hunt delivered his second major fiscal statement in five months. With the OBR forecasting that the […]

March 7, 2023

In November 2022, the Chancellor delivered what was in effect a Budget in all but name in which he cut […]

December 12, 2022

The word ‘unprecedented’ can be overused in the modern world, but when it comes to looking at events of the […]

November 11, 2022

Due to ongoing growth in our Business Advisory Services Practice (“BAS”), we are now looking to recruit a graduate to […]

September 23, 2022

Although described as a ‘mini-Budget’, the Chancellor’s Statement on The Growth Plan 2022 earlier this morning introduced a wide range […]

September 23, 2022

HNH are delighted to welcome Connor McAnallen as a Manager into our Deal Advisory team. An Accountancy graduate of Queens […]

September 20, 2022

HNH are delighted to welcome Matthew Mitchell to our Business Advisory Services team. A graduate from the University of Ulster, […]

July 8, 2022

“With increasing concerns around climate change and the cost of energy, it’s no surprise to see growing appetite for investments […]

June 6, 2022

HNH are delighted to welcome Lucas Batchelor as an Assistant Manager to our Deal Advisory team. Lucas graduated from Queen’s […]

May 27, 2022

HNH are delighted to welcome Caoimhe Sweeney as an Assistant Manager into our Business Advisory Services team. A law graduate […]

March 8, 2022

Written by Jamie Callaghan With the Chancellor’s Spring statement fast approaching, those business owners contemplating retiring or exiting their business will no […]

February 23, 2022

Written by Rory Moynagh If there has one benefit from the past 2 years, it is undoubtedly the opportunity to […]

February 2, 2022

Written by Fiona Elwood As we begin 2022, it is widely reported that rising living costs are having a financial, […]

December 22, 2021

Due to ongoing growth in our Business Advisory Services Practice (“BAS”), we are now looking to recruit an Assistant Manager […]

October 27, 2021

Today’s Budget announcement covered a lot of ground and set out the Governments direction of economic travel for the next […]

October 8, 2021

As 2021 enters the last quarter, it’s hard to tell whether we are leaving a period of uncertainty or entering […]

September 27, 2021

Due to ongoing growth in our Tax Advisory Practice, we are now looking to appoint a Tax Manager. The successful […]

September 24, 2021

HNH are delighted to welcome James McMullan to our Business Advisory Services team. A graduate from Queens, James has recently […]

September 9, 2021

HNH acted as Lead Corporate Finance Advisor for rapidly growing eCommerce business Candle Shack in a £4.4m deal. Candle Shack, […]

September 7, 2021

We are delighted to announce the promotion of John Donaldson to Director within our Business Advisory Services (BAS) team. James […]

August 12, 2021

HNH acted as Lead Corporate Finance Advisor for Powerhouse. HNH Head of Sustainability, Paul Gleghorne, commented “HNH were delighted to […]

August 6, 2021

Further to the policy papers published last year on how to both treat and support those customers with tax debts […]

July 31, 2021

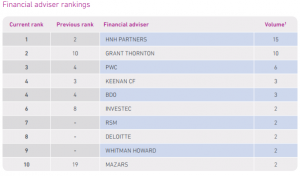

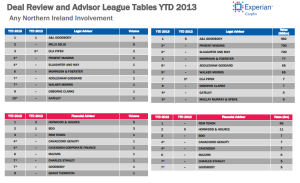

With the publication of the latest Experian M&A League Tables, we are very pleased to report that our Deal Advisory […]

June 8, 2021

A Debt Advisory team, led by Bruce Walker recently advised Athru Whiskey on a £15m ABL fundraise from PNC. This […]

May 6, 2021

It gives us great pleasure to announce that Rory Moynagh, Associate Director in our Business Advisory Services (BAS) department, has […]

April 30, 2021

We are delighted to see the efforts of our deal advisory teams in NI and Scotland recognised by their strong […]

March 26, 2021

As a result of our ongoing expansion, we are now looking to appoint a Business Support Assistant. The successful candidate […]

March 24, 2021

The Deal Advisory team at HNH is delighted to announce two pieces of good news: Chris Hylands joined the team […]

March 23, 2021

Earlier today the Government issued its ‘Tax Policies and Consultations’ document. There was speculation that this would be the opportunity […]

March 5, 2021

Fortus Group Holdings (‘Fortus’), the UK and Ireland’s value added B2B security distributor, has announced the acquisitions of Enterprise Security […]

March 3, 2021

In his second Budget, the Chancellor focused on three main areas – supporting business and people; fixing the public finances; […]

February 26, 2021

It gives us great pleasure to announce some promotions and exam successes within HNH despite continued lockdowns and a somewhat […]

February 23, 2021

Due to the buoyant M&A market and with a strong and growing pipeline for FY22, we are seeking to recruit […]

February 22, 2021

After a one-year delay due to the impact of the Covid-19 pandemic, changes to the OPW rules (sometimes referred to […]

February 9, 2021

James Neill and Cathy McLean are delighted to be presenting to the Law Society of NI this Wednesday as part […]

October 29, 2020

Scotch Whisky specialist, Aceo Limited is set on an expansion course after successfully completing a £15m ABL financing. Bruce Walker and Peter […]

October 5, 2020

A double helping of good news today as we announce two new additions to Deal Advisory and Transaction Services and […]

September 6, 2020

A team led by Rodney McCaughey has provided financial due diligence for Renatus Capital Partners on its investment in CRS […]

September 2, 2020

HNH is a multi-disciplinary financial advisory firm, combining a boutique business model with an international reach. We are based in […]

August 24, 2020

HMRC recently published two policy papers in relation to how they treat and support those customers with tax debts. This […]

August 20, 2020

Every year the tax system gets a makeover at the time of the Budget, when new rules and regulations are […]

August 4, 2020

Perhaps a new era and form of collaboration/consolidation? An already precarious business outlook for many small breweries across the UK, […]

July 21, 2020

HNH’s Scottish team uses its expertise to support Edinburgh cyber security company Despite challenging economic conditions, boutique corporate finance specialists […]

July 9, 2020

Yesterday the Chancellor made a statement to the House of Commons and unveiled his ‘Plan for Jobs’, as the second […]

July 6, 2020

The impact of the Coronavirus pandemic has been unprecedented, certainly for anyone born after the Second World War, and it […]

July 3, 2020

Deal Advisory director Neal Allen recently gave a presentation to ICAEW members in Scotland on the implications of COVID-19 on […]

June 19, 2020

The past months have had a deep and lasting impact for all of us. In February, the terms social distancing, […]

June 17, 2020

Our Transaction Services team is delighted to have advised Foresight Group on their investment into Substantive Research, a leading provider […]

June 16, 2020

Within the construction industry, ‘smash and grab’ is the term used to describe an adjudication that seeks to recover funds […]

June 11, 2020

HNH are pleased to welcome John Donaldson as an Associate Director into our Business Advisory Services division. John, a Licensed […]

May 15, 2020

For any of our clients or contacts who are unsure of what support packages are available to help them navigate […]

April 2, 2020

There is no doubt that business owners and directors are in panic mode. This is totally understandable as this type […]

March 31, 2020

The GlenAllachie Distillers Co. Limited has secured a £30 million asset-based lending package from Clydesdale Bank, thanks to support from […]

January 30, 2020

The Chancellor of the Exchequer, Sajid Javid, has announced that his first Budget will be delivered on Wednesday 11 March. […]

October 23, 2019

Three senior professionals from Scotland’s leading accountancy practices have come together to help drive HNH’s expansion into the GB market. […]

August 22, 2019

Where does a year go? HNH Tax opened for business in September 2018 and since then has been involved in […]

July 2, 2019

Whilst the political and economic landscape in 2019 has continued to be dominated by uncertainty, one option for company directors […]

April 29, 2019

We are delighted to announce the opening of an office in Edinburgh. Announcing the opening, Craig Holmes said “We can […]

April 1, 2019

SSAS Solutions has become part of listed wealth management group Mattioli Woods. SSAS is a Belfast-based firm specialising in offering […]

March 20, 2019

What is a Debt Covenant? A Debt Covenant is simply an agreement made with your funder to adhere to certain […]

March 19, 2019

HNH are pleased to announce that Singapore Aerospace Manufacturing Pte Ltd (SAM) has completed its acquisition of JW Kane Precision […]

March 6, 2019

Claims of fake news are now commonplace within the press. The accusations of untruths continue to span the internet, questioning […]

February 11, 2019

HNH Forensic Services HNH Group are delighted to announce that our Forensic Services Senior Manager Cathy McLean has successfully gained a distinction […]

February 7, 2019

HNH features prominently in the 2019 Northern Ireland Dealmakers Awards shortlists. We have been shortlisted in the Corporate Finance Team […]

December 14, 2018

The forthcoming Christmas break is, for many business people, the one time of year they can enjoy a proper break, […]

November 26, 2018

HNH Group are thrilled to announce that we’re partnering with Inspire as our charity of choice. We are completely on […]

November 6, 2018

Last week the Chancellor made a number of announcements in the Autumn budget, including signalling the end to austerity. For […]

October 30, 2018

Today the Chancellor announced that the “Era of austerity is finally coming to an end”. History will be the judge […]

October 5, 2018

In the wake of the liquidation of Carillion, the administration of House of Fraser and a number of high profile […]

October 4, 2018

The Treasury has announced that the 2018 Budget will be delivered on Monday 29 October, a few weeks earlier than […]

September 24, 2018

In the wake of the liquidation of Carillion, the administration of House of Fraser and a number of high profile […]

May 11, 2018

We are delighted to announce a number of promotions within HNH Group. Rachel Foster and Rory Moynagh are being promoted […]

April 16, 2018

By Rachel Foster There is no doubt that the effects of the liquidation of Carillion, the UK’s second largest construction […]

April 16, 2018

HNH Group Senior Manager Rory Moynagh has successfully completed the Diploma in Personal Insolvency and attained a Certificate in Personal […]

April 5, 2018

HNH Group are proud to announce that we are sponsoring this year’s BVCA Belfast Business Breakfast. As part of the British […]

February 26, 2018

HNH Group is pleased to confirm the sale of Bio-Kinetic Healthcare Limited to Kingsbridge Private Hospital, Belfast. Following the appointment […]

February 9, 2018

HNH Group has been shortlisted in three categories at Insider’s Northern Ireland Dealmakers Awards 2018. Yesterday, Insider Media published their […]

January 24, 2018

HNH has been confirmed as the leading corporate finance adviser in the Northern Ireland market. They advised on 18 successful […]

April 3, 2017

Multi-disciplinary advisory firm HNH Group has recorded the strongest year to date in its corporate finance department by completing 14 […]

November 21, 2016

Phillip Hammond’s inaugural Autumn Statement, to be delivered this Wednesday, will be the Chancellor’s first opportunity to set out his […]

March 22, 2016

The Government has announced significant reforms relating to loss relief as part of the recent Budget, although the changes will […]

March 11, 2016

HNH Group was again named ‘Corporate Finance Advisory Team of the Year’ at the annual Insider Northern Ireland Dealmakers Awards […]

November 12, 2015

News has begun to surface in recent days that the Bankruptcy term in the Republic of Ireland (ROI) may be […]

November 4, 2015

On Monday, Britain’s manufacturing PMI jumped to 55.5 for October, ahead of analysts’ expectations of 51.3, which is one of […]

August 5, 2015

The position of pensions in Bankruptcy proceedings has been clear throughout the recession, pensions remain outside of the Bankruptcy estate […]

July 8, 2015

HNH Group is delighted to announce completion of the sale of Lisburn based ‘Nelson Hydraulics’ to Lancashire Company ‘Flowtech Fluidpower […]

March 10, 2015

HNH have regained the CF Team of the Year award at the Annual Insider Dealmaker Awards in Belfast. Having previously […]

November 17, 2014

HNH are delighted to announce that both Rachel Foster and Rory Moynagh have recently passed the Certificate of Proficiency in […]

November 13, 2014

The event kicked off at 8.00pm on Wednesday 12th November, with over 1500 runners lined up at the entrance of Stormont […]

September 23, 2014

MML Capital has strengthened its position in Ireland by investing in Lisburn-based global refrigeration rental company Lowe Refrigeration. As part […]

November 10, 2013

The Mourne Observer, the largest selling weekly newspaper in County Down, has been sold for an undisclosed sum to the […]

November 10, 2013

A new initiative, recently launched by Invest Northern Ireland, will make it easier for local small and medium-sized businesses to […]

November 10, 2013

An excellent year for Horwood Neill Holmes was recognised at the recent Insider Northern Ireland Dealmakers’ Awards ceremony, with the […]

November 10, 2013

At the weekend the Northern Knights squad completed their final training session before their first match in the RSA Inter-Provincial […]

November 10, 2013

The number of deals in Northern Ireland increased by more than a third while there was a moderate dip in […]

October 8, 2013

Research published by Experian Corpfin reveals that HNH has maintained its position as the leading M&A advisor in Northern Ireland, having […]

July 29, 2013

Following the selection of the Northern Knights Cricket squad, the Knights unveiled another fine addition to their squad, new key […]

April 16, 2013

An excellent year for HNH was recognised at the recent Insider Northern Ireland Dealmakers’ Awards ceremony, with the firm picking […]

December 1, 2012

The Volume and Value League Tables, recently published by Experian Corpfin, reveal that, for the second year running, HNH (formerly […]

April 20, 2012

Seven Technologies has received investment from YFM Equity Partners, a GB-based Private Equity Fund of £6.6m. Seven is a Northern […]