For many years Autumn Statements did not create much interest outside of economic and political circles. They were more like midterm report cards that would signpost how things were going in the economy, with updates on public spending and borrowing. Since 2018 the plan was for the Budget to take place in the Autumn and then there would be an economic update in the spring to be called the Spring Statement. The theory was to avoid two fiscal events in the same year and to enable Parliament to have more time to debate and review draft fiscal legislation. However, since 2018, the reality has been much less clear cut with a plethora of ad hoc fiscal statements and indeed last year a budget statement reversal after the chaos caused by the Truss/Kwarteng budget statement in September 2022.

On 22nd November 2023 Jeremy Hunt will present his Autumn Statement to Parliament. He will no doubt be relieved that he has survived the recent cabinet reshuffle, but that relief will be significantly tempered by the thought of an election which must take place within the next 15 months. The current opinion polls, the state of the UK and global economies and the fact that the current Government has put in place fiscal measures that have led to the highest tax burden in the UK since the end of the Second World War will mean that any thoughts of job security may be temporary.

So, will the Chancellor make any surprise announcements at the Autumn Statement in a bid to both stimulate the economy and start to reverse the trends in the polls? The general thinking is that he has virtually no room to manoeuvre at the minute. Whilst tax receipts have been extremely buoyant in the last six months due partly to the better-than-expected economic growth but mainly to the impact of the increased tax burden, the impact of inflation on public sector costs and the huge increase in government borrowing interest costs (rising to over £100bn this year) will mean there is virtually nothing in the kitty for any big tax give-aways.

With that in mind, it is always worth looking at what might be included in the statement (or maybe even in the Spring Budget):

Corporation tax rates went from 19% to 25% from 1st April this year (despite the Truss/Kwarteng attempt to reverse this last year). The higher rates will no doubt impact on foreign direct investment, and it may be too early to tell whether the higher rate will result in a higher tax yield. Whilst the natural home for a Conservative Chancellor would be to lower corporation tax rates, one must remember that companies don’t vote and we are too far into the current election cycle for a cut in corporation tax rates to have any significant impact in time for the next election.

Inheritance Tax is regarded as the most hated tax in the UK — effectively paying tax on wealth that has already been subject to income tax and capital gains tax. There were some hints earlier this year that this tax may be subject to a root and branch review and that it would be adjusted so as to take most people out of the inheritance tax net, leaving only the wealthiest subject to it. However, inheritance tax is actually not paid by the majority of people and its dislike is more often about its perceived impact rather than its real impact. Whilst the cost of making some significant changes would not be enormous, it would be seen as handing a tax break to the wealthy at a time of austerity and thus it may not have the electoral impact that would make it worthwhile.

Stamp Duty Land Tax has been around for 20 years now and the rate has steadily increased over that time. There may be merit in a reduction in the rate at the bottom end of the property ladder to not only help stimulate the struggling housing sector but also to encourage younger people to get onto the property ladder. Having said that, with the base interest rates now north of 5% after a decade of interest rates closer to 1%, the reduction in SDLT rates may not give the necessary short term boost to first time buyers.

It is highly unlikely we will see any reduction to income tax rates or national insurance rates, the cost of such reductions would be just too great and any such rate cuts at this time could spark unwelcome movements in the UK government bond market similar to those seen last autumn.

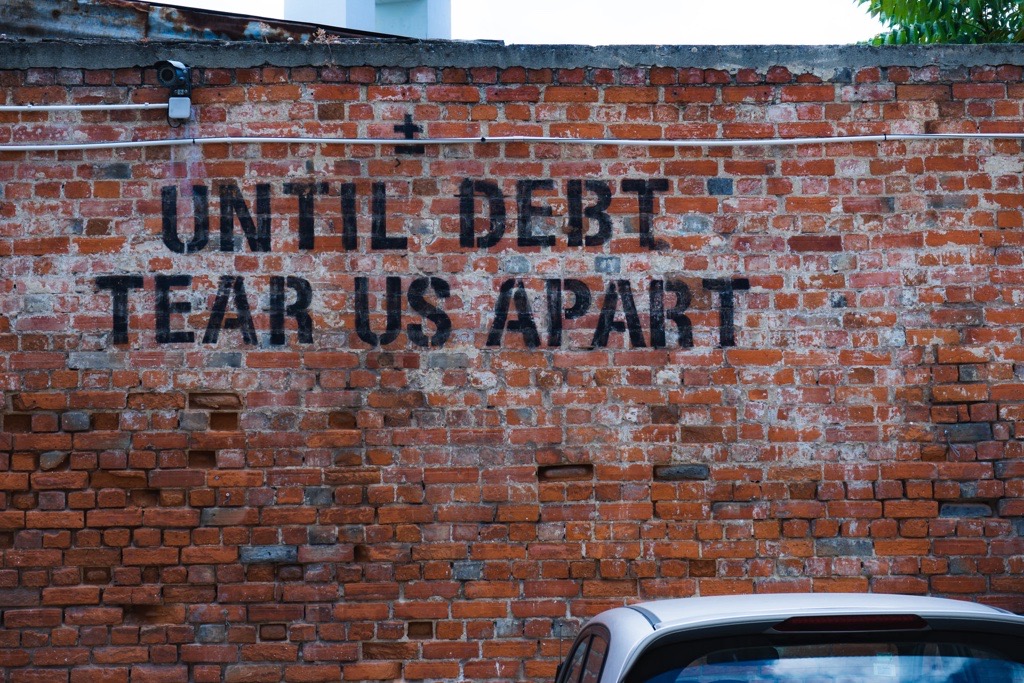

Mr Hunt is between a ‘high tax rock’ and a ‘looming election hard place’. It is hard to see him having any wriggle room just now. However, the November Statement is not quite the last chance saloon, that will be the Budget Statement next spring. I suspect the Chancellor and his government will be keeping their fingers crossed that tax receipts will stay buoyant, global economic factors will enable inflation to fall back further and that interest rates will ease back below 5%. They say a week is a long time in politics but the question is will four months be long enough for the economy to provide a window of opportunity for the Chancellor? Watch this space.